Not just the bottom

line. A better line.

Plan for the future. Hunt for opportunities.

Choose for tomorrow. Assume responsibility.

Relationships

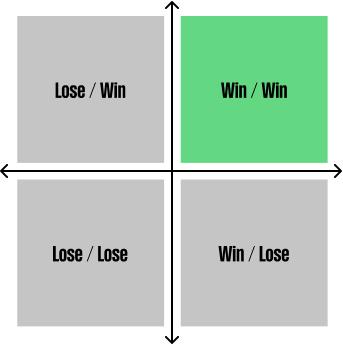

At Welltower, we believe that the hallmarks of a great business or investment has three characteristics: 1) superior returns 2) lower risk 3) long duration or longevity. Importantly, these three characteristics are not additive in nature; instead they are multiplicative (i.e. if one of those characteristics goes to zero, the entire series goes to zero). How do we seek duration? It’s through obsessing over win/win relationships with our counterparties.

Game theory, at its core, attempts to understand the optimal structure of a relationship between individuals or groups of human beings, with four possible permutations: win/win; win/lose, lose/win, lose/lose. From those four combinations, there is only one structure and design which may result in indefinite sustainability (aka duration). Win/Win. If the word “lose” appears in a relationship between individuals or groups, duration is immediately put at risk. The biggest blind spot in business is that a person or company believes they can be win/lose and still come out on top over the long-term.

We continuously focus on fairness and creating win/win solutions which result in an additive-sum mentality as opposed to the zero-sum mentality which is prevalent in our industry. Only through the achievement of duration is our pursuit of long-term compounding possible.

Data Science: Machine Learning: Deep Learning: AI

Guided by a Trillion Points of Proprietary Data

Welltower has been on a decade-long journey of building a proprietary data science and machine learning platform - the first of its kind in the $378 trillion global commercial real estate sector. The platform was initially powered by machine learning, then deep learning, and now by AI, well before many of these terms entered the mainstream vernacular. This training data set is not replicable, having accumulated operating and financial data from over 100 seniors housing operators over the past 15 years. This data is not replicable nor accessible by any other entity, creating a true moat, and allowing us to make data-driven investment decisions with pinpoint accuracy. This true competitive advantage is reflected in our superior operating results and, ultimately, shareholder returns which have far surpassed our peers.

2015

Data Science group created at Welltower, starting a shift towards a data-driven approach to real estate investing.

Significant expansion of data science team, applying early ML/AI concepts to Welltower’s seniors housing portfolio.

2016-2017

2018

Creation of "similar sites" analysis and application to seniors housing site selection.

Application of data science to Welltower’s outpatient medical portfolio; creation of physician "net need" analysis.

2019

2020

Expansion of similar sites analysis to Welltower’s multifamily (apartment) business.

Platform scaled to UK and Canada resulting in a period of significant overseas expansion for Welltower.

2021-2022

2023

Integrated OpenAI to launch internal AI solutions. Evaluation and utilization of migration trends via commute patterns and mobile phone data.

The second law of thermodynamics dictates that impact is always the greatest when contrast is the greatest: applying the hottest possible source together with the coldest possible sink. In a business sense, this is known as “disruption” – for example, introducing a new technology to challenge the status quo. How does one of the oldest laws of physics apply to real estate? Historically, real estate has been a local, “gut-feel” business, with operational and capital allocation decisions driven by one’s view of a market with minimal use of data to guide decision making. This serves as a stark contrast to all other industries where data and technology (“hottest source”) have disrupted critical elements of their business – be it dynamic pricing models in airlines or hotels, psychographics based customer targeting for retail and credit card companies, variable premiums based on driving patterns and sophisticated actuarial models by P&C insurers, or specific movie or product recommendation by Netflix or Amazon. Real estate, however, has been left untouched as a “cold sink.”

Ten years ago, we pioneered the first data science and predictive analytics platform in the real estate industry, starting with Machine Learning focused on structured data, then Deep Learning towards the end of the last decade focusing on unstructured data, and finally powered by AI over the last few years. While we will never win a prize for coming up with a new frontier model, we are harnessing the power of these incredible technology advances in human history (again, the hottest possible source) within the financial engineering driven mindset of the real estate industry (the coldest possible sink). In other words, we are disrupting how capital gets invested in the world’s largest asset class: real estate. Our proprietary data science platform allows us to make decisions through a probabilistic framework that is focused on biasing outcomes in our favor rather than chasing the illusion of certainties, i.e., positively spring loading the future.

Welltower Business System (WBS)

An end-to-end Operating Platform

In business, we often find the winning system goes almost ridiculously far in maximizing and/or minimizing one or a couple of variables. In our view, the three most successful operating companies built on that principle are Glenair, Kiewit, and Costco. It is our belief that in seniors living, that variable is to maximize the customer and site level employee satisfaction. Satisfaction of a large group of people with varied interests and needs is a complex system prone to human misjudgment when only left at the community level as it historically has been in our industry.

Enter the Welltower Business System.

The Welltower Business System (WBS) is designed to be a complex adaptive system that aims to balance chaos and order, can self-organize based on dynamic feedback loops, and adapt to changing conditions. The operational services provided by WBS is based on the fact that certain tasks are better done at scale while decision making should follow the principle of subsidiarity – pushing decisions down to the lowest, competent decision maker in the organization. For example, deploying technology solutions and completing monthly accounting tasks are generally better done at scale in a centralized format. This enables standardized data as the basis for actionable insights being delivered to decision makers on-site to drive the business. The best processes are created by understanding the key elements involved to achieve the objective, and designing business solutions that optimize the processes involved. Within seniors housing, this involves leveraging technology to optimize labor or capital, enhancing the customer and employee experience, providing robust objective data, and finally determining the highest value human interaction, where an attentive empathetic personal touch creates a delightful customer experience.

Unlike a lot of technology obsessed companies in the modern world, we do not believe everything in a complex system of human interactions is best solved with technology and AI. Last mile interactions and cross-interactions of family members, residents, and site level employees will always be at the core of our business. The goal of WBS is to bring system level thinking to remove bottlenecks, streamline flow, and minimize friction from all these interactions and focus solely on areas where scalability creates a strategic advantage, while relying on our premier operating partners to solve the unremovable complexities that are inherent in our business. WBS will provide site-level employees with real-time actionable business insights and free up valuable time to provide a real human touch to our residents.

The Welltower Business System is designed to be a service to our operating partners with their constant input to generate synergistic benefits and network effect. WBS creates operating value by providing modern, best in class business solutions to our operating partners through a relentless focus on People, Processes, Data, and Technology as well as providing operational, technological and experiential solutions to deliver a delightful customer and employee experience. In all cases, our goal remains to work shoulder to shoulder with our operating partners to deliver a killer customer value proposition to our residents and site level employees – no matter what. While implementation of the Welltower Business System is a full scale re-imagination of the operating business end to end, our core ethos of dogged, incremental and continuous progress and distinctive culture kicks in afterwards with feedback from the ground level thus creating a flywheel effect.

Capital Allocation

We, as capital allocators, strive every day to create per share value by compounding over a long period of time. While we hope near-term priorities do not conflict with those of the long term, practically speaking, we often encounter situations where these time horizons diverge. It is critical that our investors understand that, at these crossroads, we will always follow the path to long-term value creation at the expense of short-term gains. We will remain within our circle of competence, which we define as the area where we can assess and allocate capital with house odds rather than gamblers’ odds. And we invest within the boundaries of probabilities while acknowledging that the boundaries of possibilities are much wider. We remain humble and remind ourselves each day that we could be wrong; yet, we are unafraid to look foolish. This is a game of slugging percentages.

Ground Rule Document: A Letter to Future Shareholders

Every capital allocation decision we make is viewed through an “opportunity cost” prism. Doing so not only entails an evaluation of the value forgone by pursuing a specific course of action, but also compels us to consider all implications of those decisions, well into the future – what it will cost us if not done right or not done at all. In our process, we often pivot to Warren Buffet’s three questions to assess opportunity cost: “And then what, compared to what, at the expense of what.” To answer these it is critical to not just know the map, but to have a detailed view of the terrain.

We are inspired by the greatest capital allocators in the history of Corporate America, chronicled in William Thorndike’s book, The Outsiders, considered our bible at Welltower. The book recounts eight legendary CEOs who dedicated their efforts to capital allocation and long-term compounding rather than traditional corporate strategies and a myopic focus on Wall Street expectations. This book is required reading for everyone at Welltower- from summer interns to board members and everyone in between. To understand how we think about critical capital allocation decisions, please read and re-read this classic. We do so every year and learn something new. Our long-term aspiration remains to be 9th chapter of the book.

How We Invest

Acquisitions

We believe in remaining within our circle of competence, allowing us to assess opportunities and allocate capital with house odds as opposed to gamblers' odds and guided by our unparalleled data science platform. We take a granular approach to capital deployment and are focused on curating a portfolio of assets with strong regional density, creating meaningful synergies one asset and one acquisition at a time. While we strive to generate superior returns through all of our investments, we also seek a large margin of safety in all of our capital deployment decisions – that is, acquiring assets for less than what it costs to build.

Development

As in all aspects of our business, we look beyond tomorrow. We’ve built our team and created exclusive long-term partnerships with an eye towards withstanding multiple business and capital market cycles. Our Business Insights team is the cornerstone for our site and partner selection, allowing us to pinpoint seniors housing development opportunities in micromarkets with high barriers to entry and expand our Wellness Housing and Outpatient Medical portfolio in areas along the path of growth.

Structured Debt Capital

Our multifaceted investment team is trained to invest up-and-down the capital stack and across all segments where we have a competitive advantage. We only lend on assets at a last dollar exposure where we will be happy to own the asset. We also use our structured capital book to provide creative solutions to facilitate larger multifaceted transactions.

Asset Management

Welltower, standing shoulder-to-shoulder with its operating partners, is re-inventing the seniors housing industry by introducing new operational levels of excellence. Our end-to-end state-of-the art operating platform includes industry re-defining technology systems and a dedicated capital expense oversight team that is driving improved outcomes in the resident and employee experience.

Private Funds Management

Welltower Private Funds Management (WPFM) was founded in January 2025 concurrent with the launch of its inaugural closed-end fund, US Seniors Housing Fund I. WPFM will manage capital for global investment partners to pursue investments up and down the capital stack in the healthcare and wellness real estate sector. WPFM will utilize Welltower’s industry-leading data science platform to identify and evaluate potential investments and will also benefit from Welltower’s preferred and exclusive relationships as the world’s largest owner of healthcare real estate. The private capital management business will focus on complementary investment strategies to Welltower’s balance sheet and is expected to deepen our regional densification approach to portfolio construction. Additionally, the business will play a significant role in our industry leading talent management program.